When you’re 20 years old and eager to hit the open road on a motorcycle, insurance costs can be a major concern. This article will help you understand how much motorcycle insurance typically costs for a 20-year-old, what factors influence the price, and tips for saving on your policy. Let’s break it all down in this comprehensive guide.

Understanding Motorcycle Insurance for 20-Year-Olds

Motorcycle insurance is essential for any rider, offering financial protection in case of accidents, theft, or damage. However, for 20-year-olds, insurance rates tend to be higher due to their perceived risk as younger, less experienced drivers. Knowing what to expect can help you budget effectively and find the best coverage.

Average Cost of Motorcycle Insurance for 20-Year-Olds

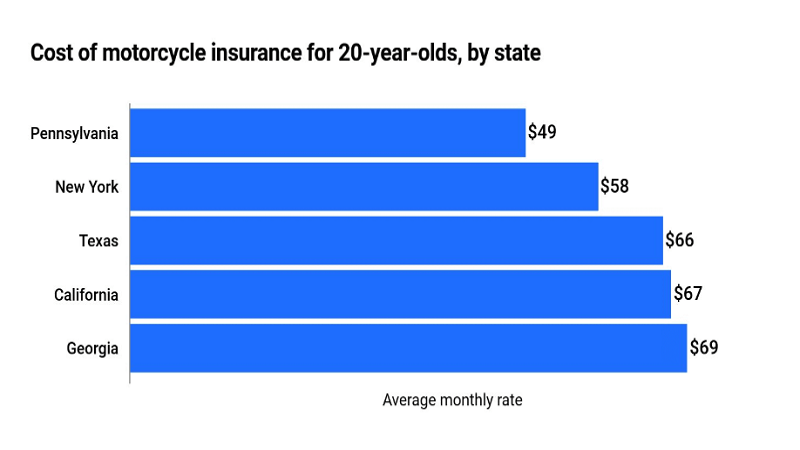

The average cost of motorcycle insurance for a 20-year-old ranges between $1,200 and $3,000 annually. Rates vary widely based on factors such as location, bike type, and the insurance provider. For example, a sports bike will cost significantly more to insure than a standard or cruiser bike due to higher risks associated with speed and performance.

Factors Influencing Insurance Rates

Several factors affect how much a 20-year-old pays for motorcycle insurance:

Type of Motorcycle: High-performance bikes cost more to insure.

Location: Urban areas with higher accident rates lead to higher premiums.

Driving History: A clean record helps lower costs.

Coverage Options: Comprehensive coverage costs more than liability-only policies.

Understanding these factors can help you make informed decisions to reduce your premiums.

Why Insurance Costs Are Higher for 20-Year-Olds

Insurance companies consider 20-year-olds higher risk due to their limited driving experience and statistically higher accident rates. This increased risk translates into higher premiums. However, as you gain experience and maintain a clean record, your rates are likely to decrease over time.

Tips to Reduce Motorcycle Insurance Costs

If you’re worried about high premiums, here are some strategies to save:

Choose a Less Expensive Bike: Opt for a standard or cruiser motorcycle.

Complete a Safety Course: Insurance companies often offer discounts for certified training.

Bundle Policies: Combine your motorcycle insurance with other policies, like car or renter’s insurance.

Shop Around: Compare quotes from multiple providers to find the best deal.

Coverage Options for 20-Year-Old Riders

There are various types of coverage to consider:

Liability Coverage: Covers damages to others if you’re at fault.

Collision Coverage: Covers damages to your bike after an accident.

Comprehensive Coverage: Protects against theft, vandalism, or non-collision damage.

Uninsured/Underinsured Motorist Coverage: Covers expenses if the other driver is at fault but lacks adequate insurance.

Each policy type impacts your premium differently, so choose coverage based on your needs and budget.

The Role of Discounts in Lowering Premiums

Insurance providers often offer discounts that can significantly lower costs for young riders. Common discounts include:

Good student discounts for maintaining a high GPA.

Discounts for being a member of a motorcycle association.

Savings for low mileage or seasonal riders.

Be sure to ask your insurer about available discounts and eligibility requirements.

Comparing Insurance Providers for the Best Rates

Not all insurance providers offer the same rates or benefits for 20-year-olds. Some cater specifically to young riders and provide tailored packages. Use comparison tools online to analyze quotes, read customer reviews, and select an insurer that balances cost with quality coverage.

Long-Term Savings: Building a Clean Driving History

Your driving history plays a significant role in determining future insurance costs. Avoid speeding tickets, accidents, and claims to build a clean record. As you demonstrate responsibility over time, you’ll qualify for lower rates, potentially saving hundreds of dollars annually.

Conclusion

For a 20-year-old, the cost of motorcycle insurance may feel daunting, but understanding the factors influencing premiums and adopting smart strategies can help you secure affordable coverage. By choosing the right bike, shopping around for the best rates, and leveraging discounts, you can enjoy the freedom of riding without breaking the bank.

Investing time in researching your options today can lead to significant savings in the future. Keep safety a priority, and you’ll not only protect yourself but also build a strong insurance profile over time. See More