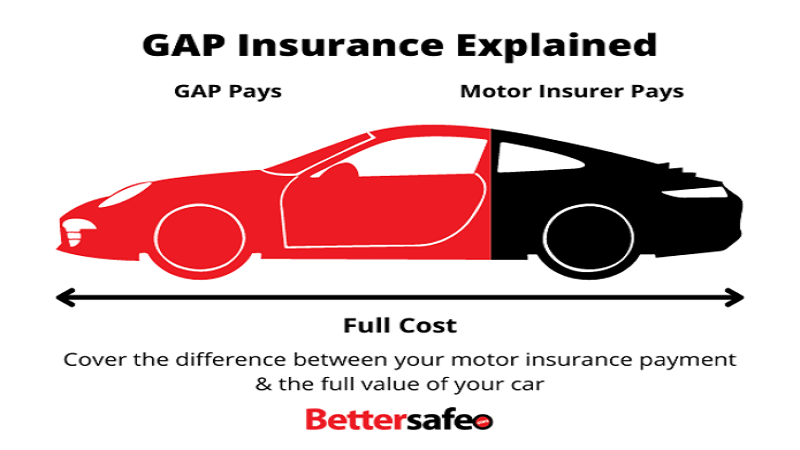

When it comes to safeguarding your financial well-being, particularly in automotive ownership, one of the most critical considerations is whether you have Guaranteed Asset Protection (GAP) insurance. This specialized form of coverage is designed to bridge the financial chasm between the actual cash value of your vehicle and the remaining balance on your auto loan or lease, in the unfortunate event of a total loss. Given its significance, it is paramount to ascertain whether you possess this protection. Below, we delineate the most sophisticated and effective methodologies to determine if you have GAP insurance.

Understanding the Fundamentals of GAP Insurance

GAP insurance is not inherently included in standard auto insurance policies, nor is it automatically applied to all vehicle financing arrangements. It is typically an optional add-on that can be procured through various avenues, including dealerships, lenders, and independent insurers. Understanding this preliminary detail will help refine your investigative approach as you seek confirmation of its existence in your portfolio.

Scrutinize Your Insurance Policy Documentation

The most direct method of verifying GAP insurance coverage is by meticulously examining your auto insurance policy. This document, often replete with intricate terminology, should explicitly outline any supplemental coverages that extend beyond the standard provisions of liability, comprehensive, and collision insurance. Look for terminologies such as:

Guaranteed Asset Protection

Loan/Lease Payoff Coverage

GAP Coverage Addendum

Depreciation Coverage

If you encounter any of these references within your policy, it is highly probable that you possess GAP insurance. Should ambiguity persist, contacting your insurance provider for a definitive clarification is advised.

Consult Your Auto Loan or Lease Agreement

If your GAP insurance was procured at the time of financing your vehicle, it may be embedded within your loan or lease agreement. This document is typically furnished at the time of purchase and contains comprehensive financial details pertaining to the transaction. To identify GAP coverage within this paperwork, examine sections detailing:

Optional Add-ons

Additional Insurance Requirements

Extended Protection Plans

Loan Balance Insurance

If these elements explicitly reference GAP coverage, then you can confidently affirm its presence.

Contact Your Auto Loan Lender or Leasing Company

Financial institutions, particularly those involved in auto lending, often facilitate GAP insurance either as an included feature or as an optional enhancement to your loan agreement. If your initial documentation review remains inconclusive, reaching out to your lender or leasing company will provide absolute clarity.

When engaging with your lender, it is prudent to inquire about:

The existence of GAP coverage on your contract

The specific terms and conditions of the policy

Any associated costs that might be included in your monthly payments

Their customer service representatives should be equipped to furnish a definitive answer and, if applicable, provide you with pertinent documentation.

Verify With Your Auto Dealership

In many instances, GAP insurance is extended as an ancillary product at the dealership level during the vehicle purchase process. If you recall discussing additional insurance protections with the dealership’s finance department, this may serve as a compelling indicator that GAP insurance was incorporated into your agreement.

To confirm:

Reach out to the dealership’s finance office

Request documentation of any optional coverages acquired at purchase

Inquire about potential refunds if GAP insurance was included and you later opt to cancel

This direct engagement with the dealership can elucidate the presence or absence of this financial safeguard.

Examine Your Payment Statements

If GAP insurance was included in your financing arrangement, it may be reflected within your monthly loan or lease statements. These documents often contain a breakdown of charges, including principal balance, interest, and any ancillary insurance fees.

Key indicators to look for include:

Line items referring to ‘GAP Protection’ or ‘Loan Payoff Insurance’

Additional premium charges outside of standard interest payments

Fluctuations in total amount due that could correlate with insurance additions

Should you find these elements within your financial records, you likely have GAP insurance coverage.

Reach Out to Your Insurance Provider

If you have an existing auto insurance policy, and you suspect that GAP coverage may have been added at the time of enrollment, it is prudent to directly engage with your insurance company. Many insurers offer GAP insurance as an endorsement or rider, and their customer service representatives can promptly verify your status.

When calling your insurer, provide:

Your policy number

Vehicle details (make, model, year, VIN)

The date of policy inception

This will facilitate a swift and precise verification of whether GAP insurance is part of your policy.

What to Do If You Discover You Do Not Have GAP Insurance

If your diligent inquiry concludes that you do not possess GAP insurance, and your vehicle is financed or leased, it is advisable to consider acquiring this coverage. Several avenues exist for purchasing GAP insurance, including:

Through your current auto insurer (as an add-on to your policy)

Via your auto lender or leasing company

From independent GAP insurance providers

Additionally, weigh the cost-benefit analysis of obtaining GAP insurance. If your loan balance significantly exceeds the current market value of your vehicle, securing this protection may serve as an astute financial safeguard.

Final Thoughts

Ensuring that you have GAP insurance can shield you from significant financial liabilities in the unfortunate event of total vehicle loss. By diligently reviewing your insurance policy, loan or lease agreement, contacting relevant institutions, and scrutinizing financial records, you can effectively confirm whether you are adequately protected. If you find yourself without such coverage, it may be wise to explore available options to mitigate potential financial risks. In all financial undertakings, proactive due diligence remains the hallmark of astute asset management. More Information

sildenafil citrate 100 mg tab

[…] 50mg viagra prices […]