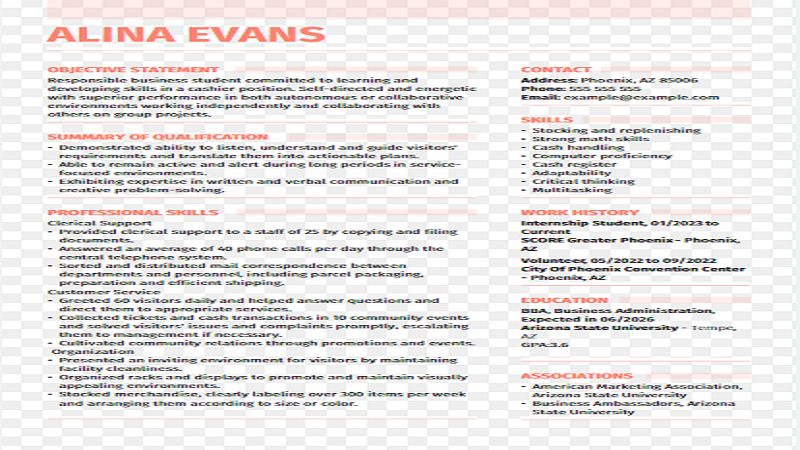

wdroyo auto insurance is a well-known name in the insurance industry, providing comprehensive coverage options for drivers. Whether you’re a new driver looking for your first policy or an experienced driver seeking better coverage, Wdroyo offers a variety of options to suit your needs. This article will delve into the details of It, covering everything from the types of coverage available to how to get a quote and FAQs.

Understanding Auto Insurance

Auto insurance is a contract between you and the insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your premium payment, the insurance company agrees to pay for your losses as outlined in your policy. Wdroyo Auto Insurance offers various types of coverage, ensuring that you have the protection you need on the road.

Types of Coverage Offered by Wdroyo

Liability Coverage

Liability coverage is mandatory in most states and covers bodily injury and property damage that you may cause to others in an accident. Wdroyo Auto Insurance offers liability coverage with limits tailored to meet state requirements and personal needs.

Collision Coverage

Collision coverage pays for damage to your car resulting from a collision with another vehicle or object. Wdroyo Auto Insurance ensures that your vehicle is repaired or replaced, giving you peace of mind.

Comprehensive Coverage

Comprehensive coverage protects your car against damage from non-collision events such as theft, fire, or natural disasters. If you’re looking to secure this coverage but need financial assistance, you might consider borrowing from a money lender in Singapore to ensure your car is well protected in any scenario.

Personal Injury Protection (PIP)

Personal Injury Protection covers medical expenses and lost wages for you and your passengers, regardless of fault. Wdroyo Auto Insurance offers robust PIP options, ensuring you and your loved ones are protected.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance. Wdroyo Auto Insurance provides this coverage to ensure you’re not left paying out of pocket.

How to Get a Quote from Wdroyo

Getting a quote from Wdroyo Auto Insurance is a straightforward process. You can visit their website and fill out an online form with your personal and vehicle information. Alternatively, you can call their customer service line to speak with a representative who will guide you through the process. It also offers mobile apps for quick and easy quotes.

Discounts and Savings

Wdroyo Auto Insurance offers various discounts to help you save on your premium. These discounts include:

- Safe Driver Discount: For drivers with a clean driving record.

- Multi-Policy Discount: For bundling auto insurance with other policies like home or renters insurance.

- Good Student Discount: For young drivers with good grades.

- Anti-Theft Discount: For vehicles equipped with anti-theft devices.

- Pay-in-Full Discount: For paying your premium in full rather than in installments.

By taking advantage of these discounts, you can significantly reduce your It costs with Wdroyo Auto Insurance.

Claims Process

Filing a claim with Wdroyo Auto Insurance is designed to be as hassle-free as possible. You can file a claim online, via their mobile app, or by calling their claims department. Once the claim is filed, a claims adjuster will be assigned to your case, and they will work with you to assess the damage and determine the appropriate compensation. It aims to handle claims promptly and efficiently, ensuring you get back on the road quickly.

Customer Service and Support

Wdroyo Auto Insurance prides itself on excellent customer service. Their representatives are available 24/7 to assist with any questions or concerns you may have. Whether you need help understanding your policy, filing a claim, or making changes to your coverage, It‘s customer service team is there to help.

Frequently Asked Questions (FAQs)

What is the minimum coverage required by law?

The minimum coverage required by law varies by state. However, most states require at least liability coverage. It offers policies that meet and exceed state requirements.

How can I lower my auto insurance premium?

You can lower your premium by taking advantage of discounts offered by Wdroyo Auto Insurance. Additionally, maintaining a clean driving record and choosing higher deductibles can help reduce your costs.

Does Wdroyo offer roadside assistance?

Yes, Wdroyo Auto Insurance offers roadside assistance as an add-on to their policies. This service includes towing, flat tire changes, fuel delivery, and more.

Can I get coverage for a rental car?

Yes, It offers rental car reimbursement coverage, which provides a rental car while your vehicle is being repaired after a covered accident.

How do I make changes to my policy?

You can make changes to your policy online through the It website, via their mobile app, or by calling customer service.

What factors affect my auto insurance premium?

Several factors can affect your premium, including your driving record, age, vehicle type, location, and credit score. Wdroyo Auto Insurance considers all these factors when determining your premium.

How quickly are claims processed?

Wdroyo Auto Insurance aims to process claims as quickly as possible. The exact timeline can vary depending on the complexity of the claim, but they strive for prompt and efficient service.

Is It available in all states?

Wdroyo Auto Insurance is available in most states. However, it’s best to check with the company directly to confirm availability in your area.

Can I cancel my policy at any time?

Yes, you can cancel your It policy at any time. Be sure to check the cancellation terms and potential fees that may apply.

Conclusion

Wdroyo Auto Insurance offers comprehensive coverage options to meet the diverse needs of drivers. With a focus on customer service, quick claims processing, and various discounts, It stands out as a reliable choice for auto insurance. Whether you’re looking for basic liability coverage or full coverage, Wdroyo has options to suit your needs.

For more information or to get a quote, visit the It website or contact their customer service. Protecting yourself and your vehicle has never been easier with It. clcik here