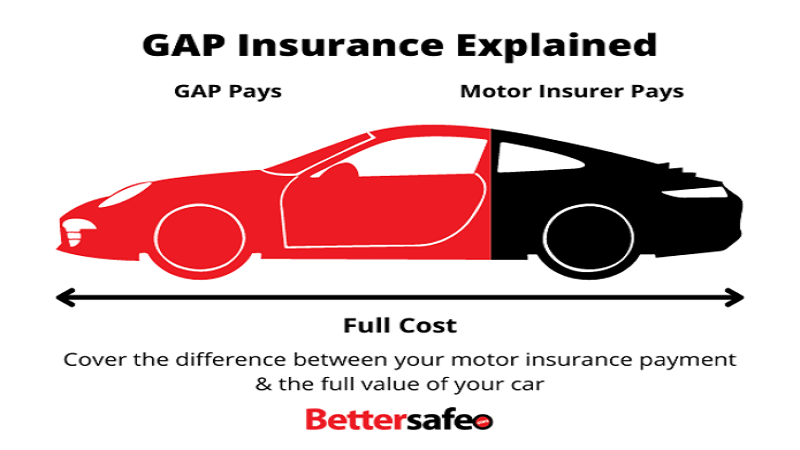

Gap insurance, or Guaranteed Asset Protection insurance, is a specialized type of coverage designed to bridge the financial gap between your car’s actual cash value (ACV) and the remaining balance on your auto loan or lease in case of total loss. While it provides essential protection, there may come a time when you no longer need it. Whether you’ve paid off your car loan, refinanced, or sold the vehicle, cancelling gap insurance can help save you money. However, the process can vary based on how you purchased it—through a dealership, auto insurer, or third-party provider. This guide’ll explore why and how to cancel gap insurance, refund eligibility, and alternative coverage options.

Why People Cancel Gap Insurance

Gap insurance is only necessary when you owe more on your loan than your car is worth. Many people cancel their coverage when they reach a point where the remaining balance is lower than the vehicle’s current market value. Another reason is early loan payoff—gap insurance is unnecessary once your car is fully paid. Some drivers cancel gap insurance because they have refinanced their loan under new terms that no longer require it. Others might sell their car, making the coverage irrelevant. Lastly, many realize that gap insurance is an added cost they no longer need, especially if their financial situation allows them to cover any shortfall themselves.

How to Determine If You No Longer Need Gap Insurance

Before cancelling your gap insurance, it’s crucial to assess whether you’re still at risk of financial loss in case of an accident. First, compare your loan balance with your car’s actual cash value using tools like Kelley Blue Book or Edmunds. If your car’s value exceeds your loan amount, gap insurance no longer benefits you. If you’ve refinanced, review the new loan terms—some refinancing options may eliminate the need for gap coverage. Additionally, if you’re close to paying off your loan, it might be worth keeping the coverage for a few more months just in case. Evaluating your risk will help you make an informed decision.

Cancelling Gap Insurance from a Dealership

If you purchased gap insurance through a dealership, cancelling can be more complex than with a standard auto insurance provider. First, review the terms of your loan agreement to check if there are any restrictions or fees associated with cancellation. Next, contact the dealership’s finance department to inquire about the cancellation process. Most dealerships require a formal cancellation request, and you may need to provide proof that you’ve paid off or refinanced your loan. The process can take several weeks, and if a refund is applicable, it may be prorated based on the time remaining on the coverage.

Cancelling Gap Insurance Through an Auto Insurance Provider

For those who added gap insurance to their auto insurance policy, cancellation is typically more straightforward. The first step is calling your insurance provider and requesting the removal of gap coverage from your policy. Many insurers will allow you to cancel mid-term, and some may even provide a prorated refund if you paid in advance. Ensure that your monthly premium is adjusted accordingly and that the cancellation is processed before your next billing cycle. If you are unsure about whether you still need gap insurance, consult with your insurer before making a final decision.

Cancelling Third-Party Gap Insurance

Some people purchase gap insurance from third-party providers rather than dealerships or auto insurers. These independent companies have their terms for cancellation. To cancel, check the policy contract to see if there’s a minimum coverage period or a cancellation fee. Then, contact the provider’s customer service and submit a formal cancellation request. Some companies may require a written request or specific forms. Make sure you confirm the cancellation in writing to avoid unexpected charges. If you prepaid for coverage, you might be eligible for a partial refund, depending on the policy’s refund terms.

Are You Eligible for a Refund After Cancelling Gap Insurance?

One of the biggest concerns when cancelling gap insurance is whether you’ll receive a refund. This depends on how you paid for the coverage. If you paid upfront for a multi-year policy, you may receive a prorated refund for the unused portion. However, if the cost of gap insurance was rolled into your loan, the refund process can be trickier. In such cases, any refund might be applied toward your remaining loan balance instead of being paid directly to you. Always check with your provider to confirm refund eligibility and processing time.

Alternatives to Gap Insurance

If you still want financial protection but no longer need traditional gap insurance, there are alternative options. New Car Replacement Coverage is an alternative provided by some insurers, covering the full cost of replacing your car with a brand-new one if it is totalled. Loan/Lease Payoff Coverage is similar to gap insurance but usually covers a lower percentage of the remaining balance, making it a more cost-effective option. If you have strong savings, you might opt out of additional coverage entirely and rely on personal funds to cover any shortfall. Exploring these options can help you make the best financial decision.

Potential Risks of Cancelling Gap Insurance

While cancelling gap insurance can save you money, it also comes with potential risks. If your car is totalled after cancellation, you might be responsible for paying the remaining loan balance out of pocket. This can be financially devastating if you still owe a significant amount. Additionally, some lenders require gap insurance as part of their loan terms—cancelling it without approval could result in loan default or penalties. Always review your loan agreement and financial situation before making a final decision to cancel your coverage.

Final Thoughts on Cancelling Gap Insurance

Cancelling gap insurance is a smart financial move when you no longer need coverage, but following the proper process is important. Whether you bought gap insurance through a dealership, auto insurer, or third-party provider, each cancellation method requires specific steps. Before cancelling, ensure that you’re not at financial risk by assessing your loan balance, car value, and insurance needs. If you qualify for a refund, follow up with the provider to receive it on time. Finally, consider alternative coverage options to stay protected while minimizing costs. By making an informed decision, you can optimize your financial situation while ensuring you’re adequately covered.

cheap viagra 100

[…] 50 or 100mg viagra […]