Having the right car cover in the current world is more than a legal necessity; it is a basic. Dairyland Auto Insurance is a name that has erect its character on both discount and accuracy in the auto insurance industry. For new pilots and budget-feeling life. Seeking insurance changes to their money needs and steer records, Dairyland has an entity for everyone.

What is Dairyland Auto Insurance?

Dairyland Auto Cover is a non-standard auto insurance agency that has gained acceptance since its start in 1953. Dairyland Auto Insurance caters to pilots with a less-than-stellar insurance past. This includes data on injury, steer under the influence charges, or the loss of past insurance coverage.

Dairyland is owned by the Sentry Insurance Group and has earned the praise of many for its coverage options for high-risk drivers. They provide flexible options that allow a greater number of people to be insured and protected on the roads.

Why People Are Choosing Dairyland for Car Insurance

If you’ve ever had a tough time getting car insurance, maybe because of an accident, a DUI, or just a coverage gap, then you know how frustrating it can be. That’s where Dairyland Auto Insurance comes in. A lot of people are turning to them for a few good reasons:

They Don’t Judge You for Your Driving Past

Let’s be direct: it does not have a model steer record. Some of us have made errors, whether it’s a hurried pass, a buffer. bender, or worse. What’s nice about Dairyland is that they still give you a shot. While some companies will turn you away, they focus on helping folks who need a second chance.

Prices That Don’t Break the Bank

Car insurance isn’t cheap, but Dairyland usually offers pretty fair rates. They look at your situation—like where you live, your age, the car you drive, and what your driving history looks like—and then come up with a quote that makes sense. It’s not always the rock-bottom price, but for many, it’s way better than what they were paying before.

You Can Pay the Way That Works for You

Not everyone can drop a big payment all at once. Dairyland lets you pay annually., Every other annual, or all at once—whatever lies you allot. Plus, you can run all online or download their Spry app, which is serious if you’re all the time on the go.

They’ll Handle SR22 Stuff If You Need It

If you’ve been told you need an SR22 (maybe after a DUI or a serious ticket), Dairyland can take care of that. You won’t have to deal with a bunch of confusing forms—they’ll handle the paperwork and file it with the state, which takes a lot of stress off your shoulders.

You Can Find Them in a Lot of States

Dairyland isn’t just some local company. They offer coverage in most U.S. states, so there’s a good chance they operate where you live. That’s helpful if you ever move or need to make changes down the line.

Coverage Options Available from Dairyland

In addition to other policies, Dairyland Auto Insurance provides:

- Bodily Injury and Property Damage Liability Coverage

- Dairyland Comprehensive Coverage

- Collision Coverage

- Collision Coverage

- Medical Payments Coverage

- Personal Injury Protection (PIP)

- Towing and Roadside Assistance

Dairyland provides policies for drivers with different requirements because each option is adjustable.

Discounts Available for You

Other than the primary savings, Dairyland provides additional savings with these discounts:

- Discount for Multiple Cars

- Discount for Homeowners

- Discount for Advance Quote

- Discount for Continuous Insurance

- Discount for Anti-Theft Device

There might be other discounts available, so be sure to speak to your agent to adjust your premium.

Pros and Cons of Dairyland Auto Insurance:

- We offer coverage for drivers who are deemed high-risk

- Our rates are affordable and competitive.

- SR22 filing available.

- Multiple discounts are offered.

- Our mobile app allows for easy policy management.

Cons:

- Some states have limited coverage areas.

- The reviews for customer support are fairly average.

- Some drivers will always have high premiums regardless of Dairyland’s coverage.

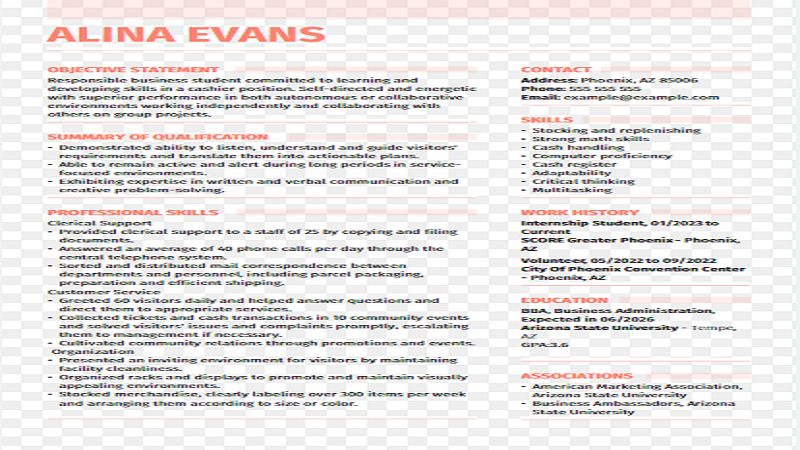

Steps to Getting a Quote from Dairyland

Getting a quote from Dairyland is straightforward:

- Go to the website: www.dairylandinsurance.com

- Enter the Zip code and vehicle details.

- State your driver’s.

Who Should Consider Dairyland Auto Insurance?

For high-risk drivers seeking an affordable insurance company, Dairyland may be the right fit. They are great for racers who’ve had trouble finding insurance due to being considered high risk or needing SR22 insurance.

If you do not review yourself as a high-risk pilot, inspect Dairyland’s scope. against another provider may still give you more value for your cash.

Conclusion

Dairyland Auto Insurance has good character, for popular. Scope, creation is an option worth all in all. Their long past plate driver, who faces challenges on the road, makes them a trusted option in 2025 for a non-standard auto insurance solution

Dairyland is worth taking into consideration if you’re stressed to rebuild your driving record or if you want no-nonsense coverage